Introduction

My name is Leo Andersen. As a former fintech journalist turned independent crypto analyst, I spend my days watching how technology changes money and the people who use it. In 2025, "Crypto in Real Life" is no longer an experiment for hobbyists - it is a set of practical tools that small sellers can use to accept payments, reduce fees, and reach collectors worldwide. Independent bookstores that sell signed editions, limited zines, and artist prints are finding unique advantages in accepting crypto, from instant cross-border settlement to attracting niche collectors who value provenance and privacy.

The category we are exploring here is crypto payment solutions for retail, with a focus on independent bookstores and creators who sell signed editions and zines. This covers hosted gateways, self-hosted processors, fiat-rail integrations, stablecoin rails, and plug-and-play hardware for in-person sales. The market has matured since the early token boom: there are more reliable custodial partners, better merchant tools, and clearer tax and compliance guidance in many jurisdictions. Yet the choices can be confusing for a shop owner who cares more about curating shelves than maintaining keys.

Crypto payments let bookstores accept global buyers with lower friction and often lower costs than international card fees. Stablecoins like USDC and USDT provide predictable pricing for sellers who want to avoid volatility while keeping the benefits of digital transfers. Self-hosted options such as BTCPay Server give full control and near-zero processing fees, but they carry technical overhead that not every bookseller can or wants to manage.

In this article I examine five proven payment solutions that independent bookstores can realistically implement in 2025. I look at usability, fees, technical requirements, in-person vs online checkout, and how each solution handles settlements in fiat or crypto. I'll also share real-world use cases, troubleshooting tips, and a buying guide to help you choose the right setup for a small store selling signed books and handmade zines. My goal is to focus on "Crypto in Real Life" - the practical steps and tradeoffs, the customer experience, and how to integrate these options into the shop's daily operations.

Trends to watch include growing acceptance of stablecoins by payment processors, improved point-of-sale integrations for contactless crypto wallets, and more simple tax reporting tools for small merchants. Consumers who buy signed editions often value direct relationships and provenance more than loyalty points. Crypto payments can boost those values by offering transparent records and immutable receipts when collectors want them.

Throughout, I will use plain language and real examples so you can see how each option fits into a bookstore's workflow. If you run a tiny store with limited staff, some of these options will be a better fit than others. If you manage an indie publisher who ships zines worldwide, you may prioritize low-fee global settlement. We'll cover both paths.

BitPay

Why this product is included

BitPay is one of the longest-running, widely used crypto payment processors for merchants. It is included here because of its familiarity to mainstream merchants, multi-currency support, and robust integrations with e-commerce platforms. For bookstores that want a hosted, user-friendly service that converts crypto into fiat, BitPay is a solid starting point. It's especially useful for shops that prefer a hands-off approach to custody and prefer payouts in local currency.

Description

BitPay provides a hosted payments gateway that accepts Bitcoin, Bitcoin Cash, and several stablecoins such as USDC. Merchants create an account, connect their bank account or payment gateway, and then integrate BitPay with Shopify, WooCommerce, Magento, or use a hosted invoice URL for manual invoices. When a customer pays in crypto, BitPay gives the merchant the option to receive funds as crypto or to settle immediately into local fiat via bank transfer.

- Familiar merchant tools and integrations with major e-commerce platforms, making setup quicker for bookstore owners who use Shopify or WooCommerce.

- Option for fiat settlement reduces volatility risk, and daily payouts keep cashflow predictable.

- Support for multiple coins and tokens including stablecoins for price stability.

- Hosted invoice links are easy for phone orders or in-person QR code scans.

- Merchant dashboard with reporting simplifies bookkeeping for small shops.

- Processing fees and conversion fees can be higher than self-hosted alternatives, cutting into small margins.

- Hosted custody means merchants rely on BitPay for withdrawals and controls.

- Limited control over on-chain transaction choices if you want to optimize fees or routing.

Technical Information and Performance Analysis

BitPay offers REST APIs for invoice creation, webhook notifications, and payment tracking. Average on-chain confirmation times depend on Bitcoin network congestion; BitPay can accept 0-confirmation payments for small amounts when using specific merchant risk settings. Typical settlement times: instant conversion to fiat with same-day or next-day ACH wiring depending on bank and region. Uptime for BitPay's hosted service is commonly reported as 99.9 percent. Fees: merchant fee structure often ranges 1 percent to 3 percent plus on-chain network fees if holding crypto. For fiat settlement, currency conversion spreads vary but are disclosed at checkout.

Example performance metrics:

- Average invoice creation API latency: 200-400 ms

- On-chain confirmation wait time for finality: 10-60 minutes for BTC under typical conditions

- Fiat payout timing: same-day to 3 days depending on bank

- Reported uptime: 99.9 percent in last 12 months

User Experience Insights and Real-World Scenarios

Bookstore use case: A cozy shop in Brooklyn uses BitPay to accept crypto for signed editions during events. They generate a BitPay invoice on an iPad behind the counter and show a QR code to the buyer's wallet app. The owner chooses fiat settlement to avoid price swings. For online shopowners selling zines worldwide, BitPay reduces chargeback exposure and simplifies cross-border sales by settling in local currency.

Users report that setup is intuitive for standard e-commerce stacks, but custom POS integrations can require developer time. Support channels are generally responsive for account issues, though compliance checks for larger volumes can add delays.

Maintenance and Care

Steps for bookstore owners to maintain a healthy BitPay setup:

- Enable two-factor authentication on the merchant account and assign manager roles to staff members responsibly.

- Verify banking details and test small payouts before relying on large settlements.

- Regularly export transaction history for tax and accounting. Do this weekly or monthly depending on sales volume.

- Keep API keys rotated and stored securely. Revoke old keys when staff change.

Compatibility and User Types

BitPay fits:

- Small bookstores with standard e-commerce platforms (Shopify, WooCommerce).

- Shops that prefer fiat payouts and minimal custody responsibility.

- Retailers hosting pop-up events or accepting phone orders.

- Merchants who want full custody and minimal fees.

- Stores needing custom on-chain fee control for microtransactions.

"For mainstream merchants the main benefit is simplicity and fiat rails that make crypto practical for daily business." - Marta Klein, Payments Researcher

Comparison Table

| Feature | BitPay | Typical Hosted Competitor |

|---|---|---|

| Fiat Settlement | Yes, same-day to 3 days | Yes, 1-5 days |

| Supported Coins | BTC, BCH, USDC, others | BTC, ETH, stablecoins vary |

| Fee Level | 1-3 percent + spreads | 1-4 percent |

User Testimonials and Case Studies

"We started accepting crypto during a signed-book event and sold two high-value editions to international collectors who preferred to use stablecoins. Payouts were smooth and bank transfer arrived next day." - Eastside Books, Portland.

Troubleshooting Guide

Common issues and fixes:

- Invoice not marking paid: check webhook URL and API key, confirm network confirmations if using BTC.

- Delayed fiat payout: verify bank routing and any pending compliance holds; contact support with payout ID.

- Customer sees wrong price due to volatility: enable instant fiat conversion or lock prices with stablecoin invoices.

Coinbase Commerce

Why this product is included

Coinbase Commerce is included for its brand recognition, ease of use, and seamless experience for many wallet users. For independent bookstores that already have customers who hold crypto on Coinbase or use popular wallets, Commerce provides a familiar checkout that reduces friction. It offers both hosted checkout pages and plugins for major carts.

Description

Coinbase Commerce is a non-custodial product from Coinbase that allows merchants to accept crypto directly into a self-managed wallet or into Coinbase's hosted custody, depending on setup. You can integrate via API, Shopify plugin, or use payment buttons and hosted checkout pages. Supported currencies include Bitcoin, Ethereum, Litecoin, and several stablecoins. Merchants can choose to manually convert receipts to fiat or keep crypto on-chain.

- Brand trust and simple onboarding for customers familiar with Coinbase.

- Non-custodial option allows merchants to control private keys if they want.

- Easy integrations with Shopify and other carts, reducing developer time.

- Hosted checkout supports QR codes for in-person payments.

- Good developer docs and webhook support for automations.

- For some regions, regulatory constraints limit functionality or require Coinbase account verification.

- Keeping crypto on exchange custody exposes merchants to counterparty risk if they choose that path.

- Fee structure can vary and conversion spreads can affect revenue for small margins.

Technical Information and Performance Analysis

Coinbase Commerce API supports invoice creation, charge objects, and webhooks. Average API response times are around 150-300 ms. On-chain confirmation times depend on network; USDC on Ethereum layer 1 can be slow during congestion, but Coinbase also supports USDC on alternative rails for faster transfer depending on support. Reported uptime is 99.95 percent for the commerce platform. Merchant fees depend on how you convert assets - there is no commerce fee for crypto acceptance, but fiat conversions and exchange spreads will apply if using Coinbase's conversion services.

Example metrics:

- API latency: 150-300 ms

- On-chain confirmation: 1-20 minutes typical for ETH, variable for BTC

- Uptime: 99.95 percent

User Experience and Real-World Usage

A zine publisher found Coinbase Commerce easy to add to their WooCommerce site and used hosted checkout links in email newsletters promoting limited runs. Collectors appreciated QR checkout at gallery pop-up events. The non-custodial wallet option gave the owner confidence to hold a small float of crypto to pay for artist commissions directly.

Some users mention occasional confusion when choosing between custodial and non-custodial options, so clear internal policies are helpful.

Maintenance and Care

Steps:

- Decide on custody strategy - if self-custody, set up secure hardware wallet and backup seed phrase in a fireproof storage.

- Enable 2FA and maintain admin access controls.

- Regularly reconcile on-chain receipts with your merchant ledger weekly.

- Plan for conversions: set thresholds where you auto-convert to fiat to avoid volatility.

Compatibility and Use Cases

Coinbase Commerce works well for:

- Bookstores that want easy Shopify integration and trust the Coinbase brand.

- Sellers who want the option to keep crypto for treasury or convert to fiat when needed.

- Pop-up events where buyers use mobile wallets frequently.

"Coinbase Commerce lowers the barrier for merchants who want a balance of usability and control." - Rahul Singh, Crypto Payments Consultant

Comparison Table

| Feature | Coinbase Commerce | BitPay |

|---|---|---|

| Custody Options | Non-custodial or custodial via Coinbase | Mostly custodial with fiat rails |

| Fees | No commerce fee for crypto receipts, conversion costs vary | 1-3 percent + spreads |

| Ease of Use | High for Shopify/WooCommerce | High for mainstream e-commerce |

User Testimonials

"Our zine sales jumped after adding a Coinbase Commerce button; collectors loved the easy checkout." - Tiny Press, London.

Troubleshooting

Common fixes:

- Missing webhook events: ensure your server accepts POST from commerce.coinbase.com and check firewall rules.

- Network slow: consider accepting stablecoins on faster rails or offer an alternate payment while network clears.

- Account holds: prepare KYC documents ahead of high-volume drops to prevent holds.

OpenNode

Why this product is included

OpenNode is included for bookstores that prioritize lightning-fast Bitcoin payments. Its Lightning Network focus makes it ideal for low-fee in-person payments and quick microtransactions for zines. For sellers who like Bitcoin and want near-instant settlement when using Lightning, OpenNode is a practical choice in 2025.

Description

OpenNode provides a gateway focused on Bitcoin and Lightning Network payments. Merchants can accept on-chain BTC, but the real value for many stores is instant Lightning invoices with fees measured in satoshis. OpenNode offers APIs, plugins for major carts, and hosted invoices. It supports auto-conversion to fiat rails as well so merchants can avoid volatility while still benefitting from low Lightning fees.

- Very low fees for Lightning payments - often under 1 percent equivalent when routed efficiently.

- Instant settlement for Lightning invoices, ideal for in-person purchases at events.

- Built-in fiat conversion if needed, giving flexibility.

- Developer-friendly APIs and easy POS integration for tablet-based checkouts.

- Lightning still requires liquidity and occasional channel management which can confuse non-technical staff.

- Not all customers have Lightning-enabled wallets, limiting reach compared with multi-coin gateways.

- On rare occasions, routing failures can cause a failed payment and require retrying.

Technical Information and Performance Analysis

OpenNode provides Lightning nodes and handles channel management on behalf of merchants; merchants can also connect self-hosted nodes if they prefer. Typical Lightning invoice settle time is under 1 second for instant payments, while on-chain BTC confirmations vary as usual. Fees on Lightning are typically a few satoshis per payment plus a small service fee if conversion to fiat is chosen. Reported success rates exceed 95 percent for well-sized channels.

Metrics:

- Lightning invoice settle time: < 1 second median

- Fee level: often 0.1 to 0.5 percent equivalent when using Lightning

- Channel success rate: 95 percent plus for common routings

User Experience and Use Cases

For a small bookstore at art fairs, accepting Lightning payments means fast transactions and lower costs for low-price zines. Customers scan a QR code, pay from a Lightning-enabled wallet, and receive a receipt instantly. For online shops selling signed editions, Lightning allows fast checkout with minimal wait times, improving conversion on international buyers who want quick settlement without fiat rails.

Maintenance and Care

Seller checklist:

- Decide whether to use OpenNode's hosted node or connect your own Lightning node for self-custody.

- Monitor channel liquidity during busy sales windows and top up channels ahead of large events.

- Train staff to handle failed routes by retrying or offering an alternate payment method.

- Keep accounting records for Lightning receipts and map each invoice to your order system weekly.

Compatibility and Buyer Types

OpenNode is great for:

- Shops with frequent low-value sales or many in-person transactions.

- Retailers who want very low fees compared to card payments.

- Collectors comfortable with Bitcoin or curious to try Lightning for microtransactions.

- Sellers whose customers mostly use custodial wallets that do not support Lightning.

"Lightning is the real game-changer for small ticket items in physical retail." - Jonas Meyer, Payments Engineer

Comparison Table

| Feature | OpenNode (Lightning) | Coinbase Commerce |

|---|---|---|

| Transaction Speed | Instant | Seconds to minutes |

| Typical Fee | 0.1-0.5 percent equivalent | Conversion spreads apply |

| Custody | Hosted or connect your own node | Non-custodial or custodial |

User Testimonial

"We sold 150 zines at a weekend fair using Lightning - the fees were tiny and we moved through lines fast." - Paper Trail Books, Austin.

Troubleshooting

Common problems:

- Failed Lightning route: try again or increase invoice timeout; check channel liquidity.

- Customer wallet not supporting Lightning: offer on-chain invoice or alternative payment method.

- Invoice expired: increase expiry window temporarily for unstable mobile connections.

BTCPay Server

Why this product is included

BTCPay Server is an open-source, self-hosted payment processor that gives full control to merchants. For indie bookstores who prioritize minimizing fees and maximizing privacy, BTCPay is a top choice. It's included because it represents the low-cost, self-custody path many small merchants find appealing if they can handle the technical setup.

Description

BTCPay Server lets you run your own Bitcoin and Lightning node and accept payments without a third-party processor. You install BTCPay on a VPS, on-prem hardware, or use a hosting partner. It integrates with WooCommerce and other carts, supports Lightning, and can route payments directly to your hardware wallet. There are no mandatory merchant fees beyond network fees and hosting costs, making it very cost-effective for active sellers.

- No mandatory processing fees beyond network fees and hosting - huge long-term savings.

- Full self-custody and control over transactions, great for privacy-minded sellers.

- Supports Lightning and on-chain payments with full customization.

- Active open-source community and frequent updates.

- Requires technical setup and ongoing maintenance - not ideal for non-technical owners.

- Hosting and node management can be time-consuming if you lack IT support.

- Liability for backups and securing keys rests fully with the merchant.

Technical Information and Performance Analysis

BTCPay Server runs a full Bitcoin node and can connect to Lightning nodes like LND or Core Lightning. Performance depends on your hosting and node setup. Typical measurements:

- On-chain confirmation waits depend on network and fee chosen; merchants can set fee bump rules.

- Lightning invoice settle time: under 1 second typical when channels are healthy.

- Hosting costs: VPS from $5 to $40 per month depending on resources; optional hardware wallets cost $60 to $200 one-time.

User Experience and Use Cases

A small chain of independent bookstores in Europe used BTCPay to accept Bitcoin for signed editions. They host a server on a small VPS, connect a hardware wallet, and reconcile orders once per day. The owner saves hundreds per month in processing fees versus card payments and retains full control of funds.

Maintenance and Care

Setup and maintenance checklist:

- Choose hosting: local hardware or VPS. For low-maintenance, a managed host is an option but costs more.

- Install full node and Lightning node. Follow official guides and secure SSH access.

- Set up automated backups for wallets and BTCPay configuration, store them offline in multiple secure places.

- Monitor node sync status, channel liquidity, and server resource use weekly.

- Apply security updates monthly and rotate credentials when staff changes.

Compatibility and Well Suited For

BTCPay is best for:

- Bookstores with basic technical knowledge or access to a friendly developer.

- Merchants who want to minimize fees and maximize control.

- Sellers who like the idea of full privacy and avoiding third-party custody.

- Shops with zero technical support and limited staff time.

"BTCPay puts trust and control back in the hands of merchants, but it demands responsibility." - Clara Rossi, Open Payments Advocate

Comparison Table

| Feature | BTCPay Server | OpenNode |

|---|---|---|

| Fees | No processor fee, only network and hosting costs | Small service fee for Lightning |

| Custody | Full self-custody | Hosted or connect your own node |

| Technical Overhead | High | Low to medium |

User Testimonial

"We run BTCPay on a small VPS and moved dozens of signed-book purchases off card rails. It's worth the learning curve for the savings." - Book Nook, Berlin.

Troubleshooting

Troubles and fixes:

- Node out of sync: check disk space and network connectivity; resync if required.

- Payment not confirmed: check mempool and fee policies, consider rebroadcasting or fee bumping.

- Channel liquidity low: rebalance channels or open new channels before events.

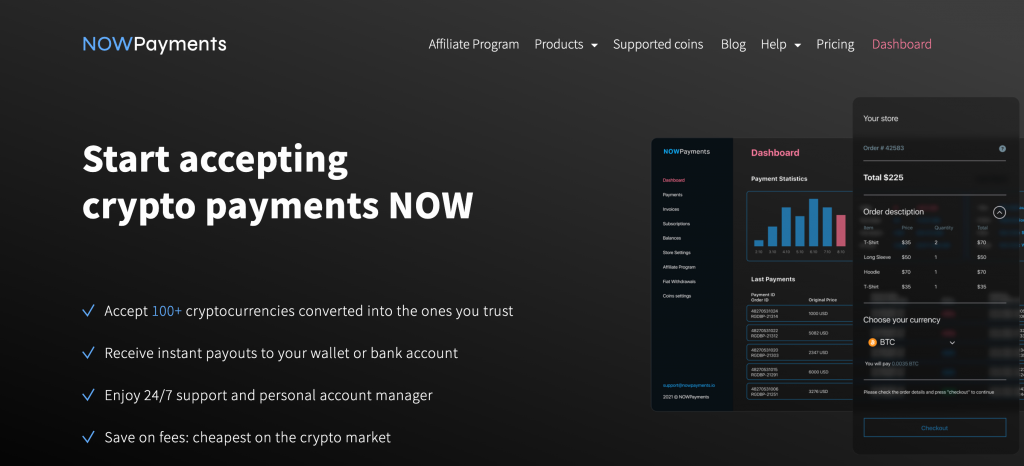

NOWPayments

Why this product is included

NOWPayments is a non-custodial crypto payment gateway that supports a wide range of coins and tokens, making it attractive for bookstores that accept niche tokens or want flexible invoice options. It's included because of its broad coin support, pay-out flexibility, and API simplicity for custom sites selling limited-run zines and signed editions.

Description

NOWPayments offers plugins for WooCommerce, Shopify, and others, plus APIs and hosted invoices. It supports hundreds of tokens and allows payouts in chosen assets, stablecoins, or fiat depending on integration. For small publishers that accept niche tokens as part of community membership perks, NOWPayments provides a flexible way to receive those tokens and optionally auto-convert to USDC for stability.

- Extensive token support giving buyers many payment options.

- Non-custodial option means merchants can receive directly to their wallet.

- Auto-convert and payout flexibility helps manage volatility.

- Simple API and plugins for quick setup on many carts.

- Wide token support increases complexity for bookkeeping and tax reporting.

- Some tokens have low liquidity, making conversion to fiat slow or costly.

- Customer support response times vary by region and issue complexity.

Technical Information and Performance Analysis

NOWPayments API supports multiple blockchains and token standards. Performance metrics:

- API latency: 150-350 ms typically

- Payout options: direct to wallet, conversion to stablecoin, or fiat payout partners where available

- Uptime: reported around 99.9 percent in past months

User Experience and Real-World Scenarios

A small zine collective accepts multiple tokens from international supporters who like to tip in small altcoins. NOWPayments lets them accept these tokens and either keep them or convert to USDC. The integration with their Shopify store was done by a freelance developer in a day.

Maintenance and Care

Best practices:

- Track all token receipts separately for accounting and tax reporting.

- Set auto-conversion rules to manage exposure to volatile tokens.

- Store private keys securely if using non-custodial payouts; use hardware wallets for holdings of value.

- Reconcile token conversions weekly and document conversion rates for bookkeeping.

Compatibility and Buyer Types

NOWPayments is well suited for:

- Publishers and shops that accept diverse crypto payments from community supporters.

- Stores wanting flexible payout options and easy plugins.

- Merchants who want a bare-minimum approach and minimal token accounting.

"Flexibility in token support opens new customer segments, but merchants must handle the accounting side carefully." - Elena Voss, Payments Advisor

Comparison Table

| Feature | NOWPayments | Coinbase Commerce |

|---|---|---|

| Token Support | Hundreds of tokens | Selected major tokens |

| Non-Custodial Option | Yes | Yes |

| Auto-Conversion | Yes | Yes |

User Testimonial

"NOWPayments let our zine shop accept local community tokens during a campaign. It was easy and opened up new supporters." - Fold Press, Buenos Aires.

Troubleshooting

Fixes:

- Token not supported by payout method: choose a supported payout asset or manually transfer tokens.

- Slow conversion: check liquidity and adjust auto-convert thresholds.

- Unexpected fees: review conversion spreads in your merchant dashboard.

Buying Guide: How to Choose Crypto Payment Processors

Choosing the right crypto payment solution for a bookstore selling signed editions and zines depends on your priorities: control, fees, ease of use, and customer experience. Below are selection criteria with a simple scoring approach, budget ranges, maintenance cost estimates, and other practical factors.

Selection Criteria and Scoring System

Rate each option 1-5 on these factors and sum the score to compare:

- Ease of setup and day-to-day use

- Fees and cost predictability

- Custody and control

- Supported payment methods (Lightning, stablecoins, altcoins)

- Integration with your e-commerce or POS

Budget Considerations and Value Analysis

Typical costs:

- Hosted gateway like BitPay or Coinbase Commerce: minimal monthly cost, fees 1-3 percent, easy setup. Good for budgets under 00/mo plus transaction fees.

- OpenNode or NOWPayments: small service fees, good middle ground for $0-$50/mo plus network costs.

- BTCPay Server self-hosted: hosting $5-$40/mo plus occasional maintenance time; hardware wallet $60-$200 initial. Best for shops expecting steady crypto volume to recoup hosting and time.

ROI: calculate monthly card fees saved vs crypto processor fees. If you process $5,000 monthly and card fees are 2.5 percent, switching to low-fee crypto can save $50-00 per month after small setup costs.Maintenance and Longevity Factors

Consider long-term costs:

- Hosted solutions require little maintenance but ongoing fees.

- Self-hosted needs backup strategies and occasional server upkeep. Budget a few hours per month or a small maintenance contract with a freelancer.

- Plan for software updates and wallet security. Expect incidental costs for hardware wallet replacements every few years.

Compatibility and Use Case Scenarios

Choose based on sale type:

- In-person small ticket sales: prioritize Lightning-capable solutions like OpenNode or BTCPay with Lightning.

- Online international sales of signed editions: favor multi-currency support and fiat settlement like BitPay or Coinbase Commerce for ease and reduced currency headaches.

- Community token acceptance: NOWPayments gives flexible token support but demands careful accounting.

Expert Recommendations and Best Practices

- Start with a hosted gateway if you are new to crypto and want minimal overhead. Test with small volumes. - Use stablecoins for pricing stability in online listings to avoid confusing customers. - If you have developer help, consider BTCPay for long-term fee savings and control. - Keep clear records of crypto receipts in fiat terms for taxes; automate export where possible.

Comparison Matrix for Decision Factors

Factor Hosted Gateway Lightning-Focused Self-Hosted Ease of Setup 5 4 2 Fees 3 5 5 Control 2 3 5 Seasonal Considerations and Timing

If you plan a holiday signed-edition drop or a zine fair, test your payment setup well before the event. Holidays bring higher traffic - ensure liquidity for Lightning channels and verification for hosted accounts is done at least 2 weeks prior. Consider offering crypto discounts for early supporters during slow seasons to build traction.

Warranty and Support Information

Hosted providers usually offer merchant support and SLAs. Self-hosted options rely on community support and your IT arrangements. Budget for a small support allocation or a developer retainer if you use BTCPay and want fast fixes during busy events.

FAQ

What basic maintenance does a crypto payment setup need?

Regular maintenance includes enabling and testing backups for wallets, rotating API keys, reconciling daily sales with on-chain receipts, and keeping server software updated. For hosted accounts, check webhook logs and payout schedules weekly to catch issues early. If you use a hardware wallet, test recovery phrases in a secure environment once a year.

How fast are settlements for each option?

Lightning payments are near-instant, typically under one second to settle. On-chain Bitcoin or Ethereum can take minutes to an hour depending on network congestion. Hosted gateways that convert to fiat can provide same-day or next-day bank settlements depending on bank rails and merchant verification.

How do I handle accounting and taxes when accepting crypto?

Keep a clear record of the fiat value at the time of each sale; export transaction history from your payment provider weekly. Use a simple spreadsheet or accounting software that lets you log crypto receipts vs conversion timestamps. For more complex token receipts, consult an accountant familiar with crypto taxation in your jurisdiction.

What if a customer pays but the invoice doesn't show as paid?

First check webhook delivery and API keys. For on-chain payments, confirm transaction ID in a block explorer and ensure required confirmations were reached. For Lightning, check invoice expiry and routing failures; often reattempting payment or issuing a fresh invoice fixes it.

Can I offer discounts or refunds in crypto?

Yes, most gateways support partial or full refunds. Refunds on-chain or on Lightning may return funds in the original asset, which can lead to different fiat values due to volatility. Plan refund policies and communicate them clearly to customers to avoid disputes.

Are stablecoins a safe choice for bookstore pricing?

Stablecoins like USDC provide predictable fiat-pegged pricing and simplify accounting. They do carry custodial and regulatory considerations depending on the issuer. Using stablecoins can reduce volatility risk, but ensure your payout option supports conversion to fiat if you need cashflow in local currency.

What are two unusual risks I should know about?

First, channel liquidity on Lightning can be drained by other network activity, so monitor before big events. Second, obscure tokens accepted via broad gateways may lack liquidity, making conversion costly or slow. Both risks are manageable with monitoring and conversion rules.

How do I support customers unfamiliar with crypto payments?

Offer clear step-by-step instructions on checkout screens, have staff trained to guide buyers through QR code scanning, and provide fallback payment methods like card or bank transfer. For events, display simple posters showing which wallets work best.

Can I use multiple processors at once?

Yes. Using a hosted gateway for general sales and a Lightning-focused solution for in-person events is a common hybrid approach. Just keep bookkeeping consistent and mark which processor handled cada sale for reconciliation.

What is the typical cost to set up self-hosted BTCPay?

Initial cost often includes a VPS at $5-$40 per month and optional hardware wallet $60-$200. If you hire a developer one-time, budget $200-$800 depending on complexity. Ongoing maintenance is mainly server updates and occasional monitoring.

How should I time setting up crypto payments before a big book drop?

Test your full checkout flow at least 2 weeks before the event. For hosted providers, complete any KYC and verification 1-2 weeks ahead. For self-hosted Lightning setups, ensure channels are funded and stable at least 3 days prior to the drop.

Is it safe to keep crypto from sales as a store treasury?

Keeping crypto can be part of a store treasury strategy, but secure custody is essential. Use hardware wallets, multi-sig where possible, and clear treasury policies. Also plan for volatility and set rules for when to convert to fiat to cover operating expenses.

Conclusion

Accepting crypto in an independent bookstore selling signed editions and zines is a practical way to reach collectors, reduce international friction, and sometimes lower fees. The right choice depends on how much control you want and how much technical work you're willing to handle. If your priority is low effort and fiat payouts, hosted gateways like BitPay or Coinbase Commerce are strong picks. If you value low fees and speed for small ticket items, OpenNode's Lightning tools shine. For merchants who want full control and minimal processor fees, BTCPay Server delivers long-term value if you can manage the setup.

Start small and test one flow - maybe a hosted invoice or a Lightning QR at a single event - before you switch major sales over to crypto. Use stablecoins for price stability if you ship internationally and need predictable pricing and accounting. If you care about long-term savings and control, invest time in a self-hosted option like BTCPay and a hardware wallet for custody.

My encouragement as someone who studies market cycles and the human side of adoption is to view this as a gradual upgrade to your payment stack. Crypto in Real Life is about small predictable improvements to customer experience, not a gimmick. Keep good records, train staff, and choose a path that matches your store's capacity for technical work. If you test one small approach carefully and iterate, you'll find a setup that fits your community and supports unique sales like signed editions and limited zines.